Thanksgiving Turkeys Are Cheaper In 2024—But California Still Leads Mainland In High Prices – Financial Freedom Countdown

Thanksgiving 2024 brings good news for most Americans: the cost of a turkey has dropped 12% compared to last year. Yet, Californians continue to face the highest turkey prices in the continental United States, with a 15-pound bird averaging $39.85, according to a new analysis from FinanceBuzz.

This year’s data reveals significant disparities in turkey prices across the nation, with shoppers in Hawaii paying the most. A 15-pound bird in the Aloha State will set the holiday budget back $52.85, nearly 70% more than the national average of $31.16. Alaska follows closely behind at $44.85, reflecting the persistent high cost of living in non-contiguous states where transportation of goods significantly raises prices.

For mainland residents, California’s turkey prices lead the pack. A 15-pound Butterball turkey in the Golden State averages $39.85, a notable jump compared to other states in the contiguous U.S.

Hawaii: The Nation’s Most Expensive Turkeys

Hawaii tops the list of states with the priciest turkeys, with a 15-pound bird costing an average of $52.85. The high transportation costs to the islands significantly contribute to this hefty price tag.

Alaska: High Prices in the Last Frontier

Alaska follows closely, with a 15-pound turkey averaging $44.85.

Like Hawaii, the state’s remote location and dependence on imported goods make holiday feasts an expensive affair.

Mainland shoppers in California face the highest turkey prices, with a 15-pound bird averaging $39.85.

High demand and elevated living costs in the Golden State push prices higher than most other states.

Connecticut: East Coast Prices Rank High

Connecticut reports one of the highest turkey costs on the East Coast, driven by a combination of transportation expenses and a higher cost of living.

Elevated Turkey Prices By State

While California tops the mainland charts, other states also report elevated costs.

The top 10 states for pricey poultry include Connecticut, Montana, New Jersey, Nebraska, New York, Minnesota and Georgia.

Oklahoma: The Nation’s Cheapest Thanksgiving Turkeys

Oklahoma offers the lowest turkey prices in the country, with a 15-pound bird averaging just $19.75. The state’s central location and access to major distribution channels contribute to these savings.

Louisiana: Bargain Turkeys in the Bayou

Louisiana shoppers can snag a 15-pound turkey for $19.80 on average, just slightly higher than in Oklahoma. This affordability makes it a standout state for budget-conscious holiday cooks.

Mississippi: Low Prices in the Magnolia State

Mississippi ranks among the cheapest turkey markets, with a 15-pound bird costing an average of $22.30.

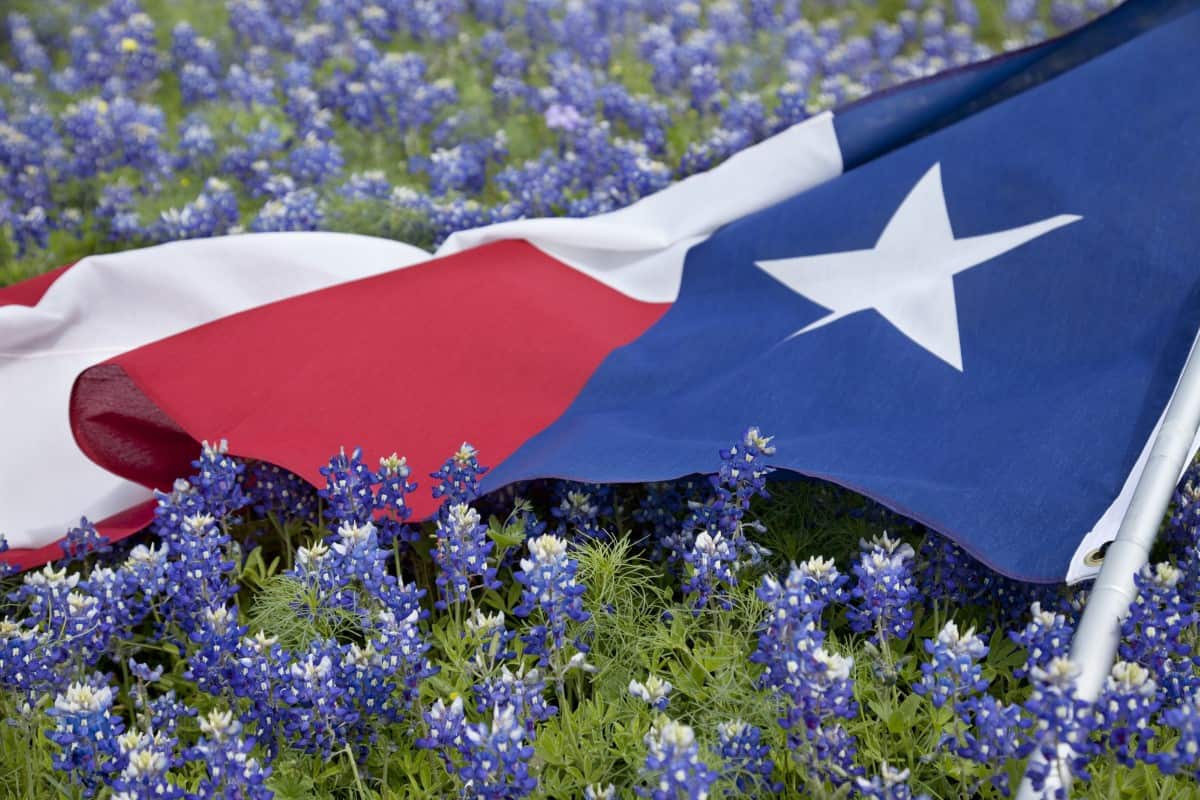

Texas: Affordable Feasts in the Lone Star State

Texans enjoy low turkey prices, with a 15-pound bird priced at $22.60 on average, reflecting strong competition among grocery chains in the state.

Illinois and Ohio: Low Costs in the Midwest

Both Illinois and Ohio tie for fifth place among the least expensive states for turkeys, with a 15-pound bird costing $22.85. Their central location and efficient distribution help keep prices affordable.

Behind the Numbers: How Turkey Prices Were Calculated

FinanceBuzz researchers surveyed turkey prices at a minimum of three grocery stores in each state, focusing on regional chains and national retailers.

Prices were based on Butterball-brand turkeys weighing 12–26 pounds, averaged on a per-pound basis, and scaled to reflect the cost of a 15-pound bird.

Minnesota: The Top Turkey Producer

Turkey production remains concentrated in a handful of key states, which collectively account for a large portion of the nation’s supply.

Minnesota leads the nation, producing 38.5 million turkeys in 2023. Its dominance in the industry stems from its established poultry farming infrastructure and favorable climate for turkey production.

North Carolina: A Poultry Powerhouse

North Carolina follows as the second-largest producer, raising 29 million turkeys in 2023. The state’s robust agricultural sector supports its high production numbers.

Arkansas: A Central Hub for Turkey Farming

Arkansas secures third place with 27 million birds, leveraging its central location and extensive farming networks to meet holiday demand.

Indiana ranks fourth, producing 20 million birds. Rounding out the top five is Missouri, contributing 17 million birds to the nation’s turkey supply.

These states collectively account for a significant portion of the 218 million turkeys produced nationwide in 2023, underscoring their critical role in feeding Americans during the holiday season.

Turkey Production Slump Threatens to Disrupt Holiday Traditions

The U.S. turkey industry has faced a significant downturn, with production from January to September 2024 down 6.3% compared to the same period in 2023, according to the USDA.

Total turkey meat production is projected to reach only 5.11 billion pounds by year’s end, continuing a multi-year decline.

Consumption has mirrored this trend, falling from 5.26 billion pounds in 2019 to a projected 4.69 billion pounds in 2024.

Why Are Turkeys Cheaper in 2024?

The drop in turkey prices marks a welcome change after years of inflation and pandemic-related disruptions. In 2022, the bird flu outbreak caused a spike in poultry prices, compounding the effects of supply chain issues.

This year, the average cost of a 15-pound turkey is $31.16 ($2.08 per pound), compared to $35.40 ($2.36 per pound) in 2023. The 12% decrease reflects a stabilization in the poultry market and easing of broader inflationary pressures.

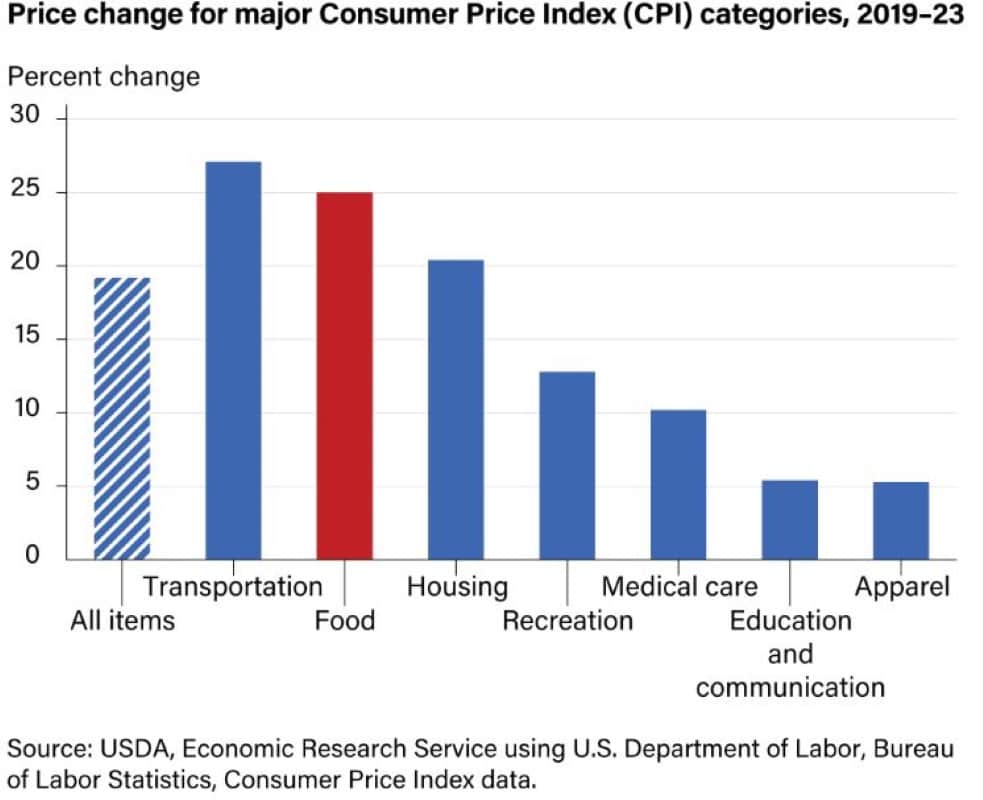

Food Prices Still High

However, food prices remain a concern for many. Between 2019 and 2023, the U.S. Consumer Price Index for food rose by 25%, driven by pandemic-related disruptions, the conflict in Europe and inflation. Although turkey prices are down, the broader cost of a Thanksgiving meal is still influenced by these lingering factors.

What This Means for Your Thanksgiving Budget

As Americans prepare for the holiday, the landscape for turkey prices offers a mix of relief and challenges.

Lowest prices: Oklahoma ($19.75) and Louisiana ($19.80).

Highest prices: Hawaii ($52.85), Alaska ($44.85), and California ($39.85).

National average: $31.16 for a 15-pound bird.

Despite the drop in turkey prices, Californians and others in high-cost states may still feel the pinch. The turkey remains the centerpiece of the meal, and its price often dictates overall spending on holiday groceries.

This year, shoppers are advised to plan ahead, compare prices at local stores, and consider freezing deals early to maximize savings. While turkey prices may have cooled, the broader financial pressures of the holiday season remain top of mind for many families.

Like Financial Freedom Countdown content? Be sure to follow us!

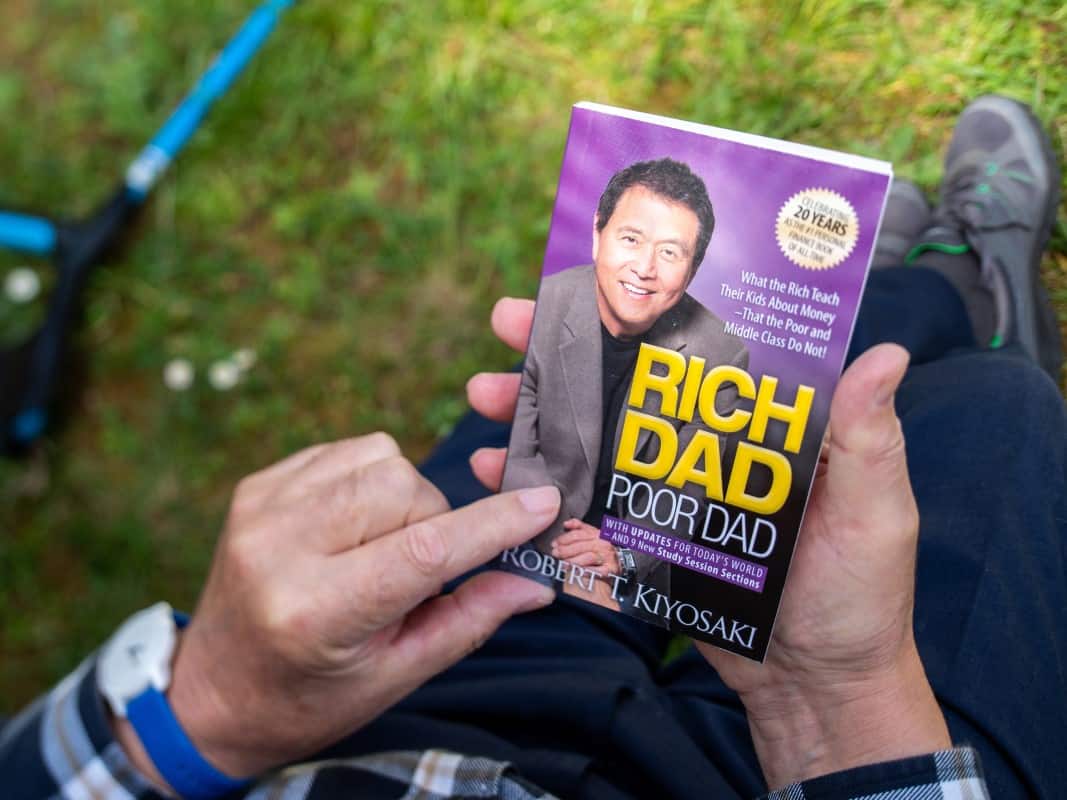

Transform Your Finances by Shifting From an Employee to an Investor Mindset With Kiyosaki’s Cashflow Quadrant Methodology

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom. One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

Buy, Borrow, Die: The Controversial Tax Loophole the Rich Use to Build Generational Wealth

The “Buy, Borrow, Die” strategy is a favorite among the affluent, who work with financial planners to sustain their lavish lifestyles while slashing their tax bills. Though it seems like a modern trend, Professor Ed McCaffery coined the term in the mid-1990s to explain how the wealthy legally avoid paying taxes.

Buy, Borrow, Die: The Controversial Tax Loophole the Rich Use to Build Generational Wealth

While many envision tax-friendly golden years, residents in ten states face a harsh reality as their Social Security benefits are taxed. In contrast, two states are offering relief by ending their practice of taxing these benefits. And one state has a phased implementation to end taxation of Social Security benefits. This shift highlights the complexities of retirement planning in the U.S. and underscores the importance of staying informed about changing tax laws. Are you living in one of these states? Discover how these tax changes might impact your retirement strategy and whether it’s time to reconsider your locale for those serene post-work years.

Treasury I Bond Rates Drop from 4.28% to 3.11% — But with a 1.2% Fixed Rate Locked for 30 Years, Is It Still a Smart Investment?

Inflation has become a significant concern. During the past three years of surging inflation, I bonds offered a safe and attractive investment option. However, with recent lower CPI numbers, the current composite rate for I bonds has dropped to 3.11%, a sharp decline from the enticing 9.62% annual rate available in May 2022 or even the 4.28% available for bonds purchased before October 31st. As rates decrease, investors are now considering whether it’s still worth buying Series I bonds.

![]()

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.